First of all, I felt really moved for all the warm comments I received in the last post wishing me the best in my wedding – and married life. My future wife, Mrs. Wolf (as she was nicknamed in on of the comments), also read them and was not less moved than me. The wedding will be on November 30th, and I’ll post a couple of pictures when I return from my honey moon, around the 11th.

Now, let’s go to what really matters (I hope she doesn’t read this line :))

In the last posts I showed a chart pointing to some sort of bottom this week, between Monday and Thursday. The bottom did happened yesterday but, as some might have noticed, I posted a comment saying that I didn’t feel confident enough in this bottom since it wasn’t originated from significant bottoms. I also said that I would keep studying to find a better window time for a bottom, consistent with some sort of pattern or pointing to significant bottoms/tops. Although yesterday we had a new low for the year followed by a sharp rally, I didn’t buy it (in all the senses of the word). I don’t know exactly why, maybe because it wasn’t low enough, maybe because it wasn’t relating to significant tops or bottoms, it doesn’t matter. It just didn’t have that look or feel that the end of a correction has. I believe many made a lot of money yesterday, but also many lost wads of cash. Luckily, not me. I’m a very conservative trader and I don’t place a trade when I don’t feel confident about it. Believe me, I can see the market swing up and down for days without doing anything, and I don’t care. I get in when I feel good about it, and I need to feel comfortable in a position, or I just dump it, profit or loss. I am proud that I got to that level that I am uncomfortable with losses and comfortable with profits (surprisingly, the vast vast majority of people behave the other way: they are able to carry a losing position for days, or even weeks, but close a profitable position in a couple of hours or even minutes).

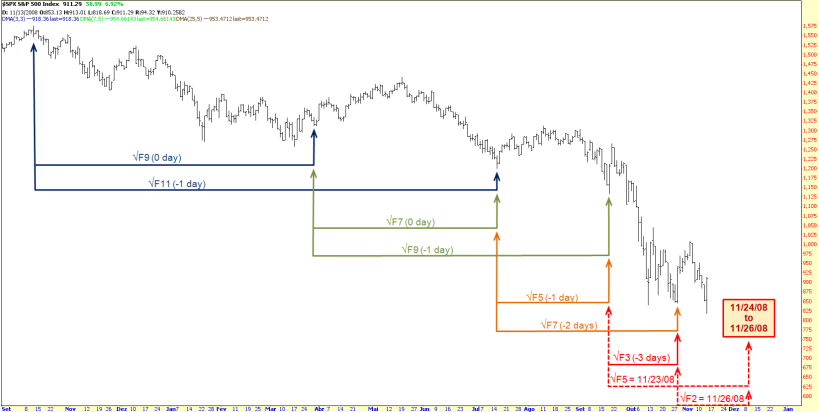

Anyway, I was looking over the data I have and I couldn’t find another cluster of dates before the end of the year. But I know if there is another low coming – and I believe there is – it’s going to happen soon. So, there must be something in that data that I’m not seeing, some sort of pattern this correction has been following in terms of time. In the last days I’ve been obsessed trying to find the dynamic of this correction and it cost me some nights of sleep. Finally, yesterday morning, fidgeting with the charts and data, totally wasted (I know, it’s such a clichè, but it’s true), I had my Eureka moment. Ladies and Gentlemen, here is what I found: The Spiral.

Please, click on the chart above to see it in its full resolution, because it’s something really beautiful, because it’s perfect. It’s beauty the way Kant defined it (Critique of Judgement), something that only happens in nature, and what you see in the chart above is a pattern in the nature of human mass behavior, as perfect as the shape of a galaxy: a spiral.

The above chart is important because it covers the whole correction – from the top on 10/10/07 – following a pattern. As you can see, we are nearing the end of the spiral and this first part of this huge correction. It points to the dates between the 23rd (which is a Sunday, so I’m using the 24th, Monday) and the 26th of November. During these days we might see the final bottom.

Let’s not get overexcited with any trades and let’s always have in mind that anything can happen. I believe we’re going to rally a couple of days, maybe a sharp rally, and then we’ll turn 180 degrees and head for the last drop. A last advice: whatever you do, stay small. If you go big (proportionally to your portfolio), emotion will take over and you’ll stop thinking and be vulnerable to silly mistakes. This is the most difficult market environment to trade and the most important thing is to stay alive during these times. The so called “pros” got fried. You didn’t. You are the new “pro,” no matter how small or big you are. So, be a “pro” and trade using your brain. Remember: you are always one trade away from humility.

Hi there and congratulations on your upcoming wedding! Thank you for your posts here and at SOH (with Tim Knight).

Could you please elaborate more on this spiral pattern. I am sorry but never heard it before.

Comment by thyname — November 14, 2008 @ 2:53 pm |

Beautiful chart that goes along with my beliefs concerning this market. Thanks for the words of wisdom and I believe that yes, us little guys and gals sitting at our desks in our home or work office are the “new” pros. Keep up the great work with your charts. Best to you and your new wife.

Sincerely, Rose

Comment by Rose — November 14, 2008 @ 2:53 pm |

great chart………bravo……

you have been very good at finding true reversal dates and I guess it will work again. A lot of happyness to you and your soon to become wife from Northern italy.

Comment by giorgio — November 14, 2008 @ 3:04 pm |

thyname, you should read Chris Carolan’s book, The Spiral Calendar. These dates I show in the above chart are relating to each other in a sequence with perfect golden proportions: F11/F9=1.382, F9/F7=1.382, and so on. This makes for a perfect spiral in time.

Comment by moontrader — November 14, 2008 @ 4:10 pm |

Ciao Giorgio, un grande abraccio a tutta l’Italia. Ho vissuto 3 anni a Roma, ho tanti amici lí. Sono stati anni bellissimi. Ho anche amici a Trento. Dei pazzi :)

Comment by moontrader — November 14, 2008 @ 4:12 pm |

Hey rose, thanks for passing by and for the wishes.

Comment by moontrader — November 14, 2008 @ 4:13 pm |

Hi moontrader, I’ve been reading your posts for the last 2 weeks. I just wanted to drop a message to say “thank you”. I really appreciate your intelligent technical analysis and efforts to keep us informed. Congratulations on your upcoming wedding!

Comment by Playa Del Carmen — November 14, 2008 @ 4:43 pm |

Moon, I really enjoy your site. Thanks for unselfishly sharing it, I know this stuff takes time. All the best to you and your fiancee! Toad

Comment by Toad — November 14, 2008 @ 6:06 pm |

Moontrader, it is fascinating, and it fits with some other key reversal dates of 770 in the SPY that 2 Sweeties talks about. Can you project the reversal forward in time, after this date? Thanks

Comment by bKudla — November 14, 2008 @ 6:25 pm |

Congrats Moontrader! 11/30 is my parents anniversary also. Best wishes!

Comment by Matt — November 14, 2008 @ 8:32 pm |

You seem like a nice guy, but if you think we are in a “correction” your nuts. As for a final low on your date, not a chance, none, zero, nada, though it might represent an intermediate term low.

Comment by Edwardo — November 14, 2008 @ 11:09 pm |

That should be, you’re nuts.

Comment by Edwardo — November 14, 2008 @ 11:11 pm |

Hello,

I would like to bring to your reader attention the spx or spy chart of march 2008 during the same time period that we are in right now. Very similar action which would suggest a beginning of week leading us down some more and tuesday same. Wednesday should prove to be another intraday reversal at which point 825 spx should hold, then we rally till friday, perhaps all the way up to 985, give or take 10points. Now, for a new low to be made during the following week, I would probably be looking for later in the week as opposed to monday or even tuesday…however the trend will be down all week! My target is 800 for the spx! Happy trading to all, and profits are always better than being exactly right!

Comment by Anonymous — November 15, 2008 @ 12:00 am |

“In boca de lupo” to your marriage (sorry if misspelled), Moontrader! What is your take on Aug-Nov 1974 SPX?

Comment by GEO — November 15, 2008 @ 12:48 am |

Edwardo:

I believe moon is referring to “low for the year”; not necessarily the low for this bear market.

Comment by DalalStreetKing — November 15, 2008 @ 2:31 am |

Hello bKudla;

Regarding your comment “… and it fits with some other key reversal dates of 770 in the SPY that 2 Sweeties talks about…”

When I read 2Sweetie’s stuff, he talks about daily, weekly, and monthly reversal levels. Can you please point me to where he talks about key reversal dates of 770″

Thanks.

Comment by DalalStreetKing — November 15, 2008 @ 2:35 am |

Bravo, Moony!

What can I say? I can only confirm your analysis with my basic triangle analysis :)

Comment by Fork_Master_Serge — November 15, 2008 @ 3:55 am |

Thanks for your great insight ! ….. i have been thinking for a while that s&p500 should trade

below 800 before a major market low is in place .

Comment by Padmosteruk — November 15, 2008 @ 9:30 am |

I’m new to the site ; Nonetheless, Congratulations on your upcoming wedding. If you are as selfless in your marriage as you seem to be with this website and a true intent to help others, I have no doubt as to its long-term success.

Regards,JD

Comment by Stksgt — November 15, 2008 @ 9:44 am |

A lot of wisdom packed into a short essay, Moontrader; thanks. For those of you interested in Astrology, you might go to http://www.stariq.com and check out Ray Merriman’s Market Week; he nailed the reversal surrounding last week’s Full Moon. And he looks ahead to December, where the real fireworks are likely to take place. Even if you scorn astrology, there is some good time period analysis to inform your stance in the next few weeks. Additionally, you might go to http://www.starlightnews.com and click on Nancy’s Blog, where the astrological cycles are fleshed out with regard to larger political developments. Put the two together, and we are probably going to have a major reversal, and maybe a longer lasting one, around the next Full Moon on December 12, or in the days immediately following. Moontrader, maybe you could fix your eyes on that time period and see if any patterns emerge. And for those of you just looking for a good read, check out http://www.portfolio.com/news-markets/national-news/portfolio/2008/11/11/The-End-of-Wall-Streets-Boom#page9 for an inside view of the investment banks’ collapse.

Comment by Alan — November 15, 2008 @ 11:19 am |

moon:

With respect to “I believe we’re going to rally a couple of days, maybe a sharp rally, and then we’ll turn 180 degrees and head for the last drop.”, do you have any targets for the “sharp rally” and the “last drop”?

Thanks.

Comment by DalalStreetKing — November 15, 2008 @ 11:21 am |

Moony,

Larry Pesavento agrees with you too! :)

Larry Pesavento on Tiger with turning dates “November 25th – big Astro Day”

[audio src="http://tfnn.s3.amazonaws.com/LarryPesavento111408.mp3" /]

Comment by Fork_Master_Serge — November 15, 2008 @ 12:41 pm |

great chart, congratulations moon! A lot of happyness to you and your wive from Poland! Regarding your comment how in your opinion can the marke fall???

An interesting article below, take care!

http://www.safehaven.com/article-11819.htm

Comment by krach — November 15, 2008 @ 1:53 pm |

Moon,

Congratulations for your wedding.

Here are there pictures that are must gifts in Chinese for wedding(as well as in Japan, Korean, Vietnam)

I sincerely hope you “good fortune”, get your son and daughter early.

“good fortune”

date in Chinese means “early”

peanut in Chinese means “mix” and “produce”, – here it means “getting sons and daughters”

Comment by David YZ — November 15, 2008 @ 9:17 pm |

By spirals are you referring to the Golden Ratio http://en.wikipedia.org/wiki/Golden_ratio ? If so, there’s a movie about this called Pi – http://tech.mit.edu/V118/N32/api.32a.html The central character eventually finds the pattern in the stock market.

Comment by flandrumhill — November 16, 2008 @ 7:28 am |

Howdy MoonTrader,

First, congrats on your upcoming marriage.

I’m running into our tenth anniversary and life is fine.

It helps when you marry your best friend.

I like your analysis and have worked together a GUT approach between your lunar cycles, EWT from evilspeculator, some MaxPain and my own fundies + SloStochs.

From a design layout PoV I didn’t know if you placed the “11/24/08 to 11/26/08” box and arrows a wee farther to the right than the dates actually are – or – if your arrows pointing up over DEC 8 to 10 is where the math actually worked out.

??

I went with what you stated, and figured the chart was “representational”.

I’m wondering if the lunar cycle thing only points to lower lows?

Since MaxPain for DEC is at $111 (And not that I give a whole lots of weight to MP, but for argument’s sake) could the lunar low on NOV 24 to 26 be a higher low, rather than a lower low, on the way up to the DEC $111 (probably lower as time progresses) target?

TIA!

Comment by fuzzygreysocks — November 16, 2008 @ 2:03 pm |

Higher Low scenario

Is this possible? Does it satisfy or violate your work?

Comment by fuzzygreysocks — November 16, 2008 @ 2:13 pm |

Moon,

congratulations for your upcoming wedding!!

2sweeties

Comment by 2SWTrading — November 16, 2008 @ 5:38 pm |

An excellent chart!

I have been following the spiral calendar for some time and I notice there are a couple of additional relationships between the highs and lows shown in the chart and the 11/24-11/26 timeframe:

7/15/08 is f8 (sorry no sqrt sign) to 11/27/08

8/11/08 is f7 to 11/25/08

They don’t fall into the same beautiful progressive pattern but they add weight to that late Nov cluster.

Comment by Dave — November 16, 2008 @ 5:54 pm |

And one more – 12/11/07 – the secondary high after the 10/11/07 top is f12 to 11/29/08

Comment by Dave — November 16, 2008 @ 6:00 pm |

So am buying tomorrow and shorting on 24th :)

Comment by experx — November 16, 2008 @ 10:07 pm |

The target date is for a market turn in the 11/24-11/26 area, so how to trade it all depends what the market does between now and then.

If the market falls it would fit into Carolan’s “Autumn Panic” scenario that bottoms about 2 days before the new moon which is on 11/27. However Carolan thinks we already had the panic down to the 10/10 low based on the record VIX value. We could still have a steep decline that is less severe that the early Oct decline that would fit with an Elliott fifth wave that goes lower than the third wave but isn’t technically as strong.

If we rally here, that time window might be a good place to sell into either flat or short.

Comment by Dave — November 16, 2008 @ 10:29 pm |

Sorry I’m not trying to spam this blog with a flurry of posts but I just noticed an interesting self similarity in the above chart. If you look at the initial decline from 10/11/2007 to the 1/22/2008 low (roughly the first quarter of the chart) it bears a striking similarity to the entire chart as far as it goes. The 10/10/2008 to present triangle in the large chart matches a smaller triangle running from 1/9/2008 to 1/15/2008 that is followed in the smaller section by a steep decline from 1/15/2008 into 1/22/2008. If the large chart is following the pattern of the initial section in a fractal, self-similar way, then we are in for the sharpest decline yet starting soon.

Comment by Dave — November 16, 2008 @ 10:47 pm |

Good catch, Dave

it could project below 600 if it plays out and I think it is 5 of 3.

I just can’t get it wrapped aroud December 22 crash date yet.

Comment by Forkoholic Serge — November 17, 2008 @ 12:26 am |

Hello to all and thanks a lot for dropping by. I was away for the weekend, with no internet connection, so I couldn’t reply to your posts. Will try to do it now, to most of you.

Comment by moontrader — November 17, 2008 @ 7:39 am |

Flandrumhill: yes, I’m referring to the Golden Ratio. I’ve seen parts of that film, pretty cool.

Fuzzygreysocks: the square with the projected dates is representational. The lunar cycle thing points to reversal dates, but since in the chart above I’m using only bottoms, then I would expect a bottom. Later today, in a new post, I’ll remind you that the projected date is likely to produce a bottom, which might or might not be a new low. I expect a new low based on other chart readings.

Comment by moontrader — November 17, 2008 @ 7:45 am |

Hey David YZ, thanks for the “gifts”! I’ll follow your advice and get my family growing soon.

Comment by moontrader — November 17, 2008 @ 7:46 am |

Fuzzygreysocks, your second chart doesn’t violate my study. As I said before, I would expect a some sort of bottom, but the lower low forecast is also based on other readings, like MACD and the three DMA’s I use.

Comment by moontrader — November 17, 2008 @ 7:50 am |

Dave, the dates you mentioned do add weight to the study above. I was trying to find a pattern for a new low, instead of the usual date cluster, that’s why I didn’t show isolated dates.

Comment by moontrader — November 17, 2008 @ 7:54 am |

Dave, interesting you mention in your fractals comment. I’ll do some research later today. As I said in previous posts, close to these important projected dates, the market has a similar behavior to reversal dates in the past, so we can have a good reference. I’ll try to find some sort of reference.

Comment by moontrader — November 17, 2008 @ 7:59 am |

Hey fuzzygreysocks

how do u calculate MAXPAIN?

Comment by Forkoholic Serge — November 17, 2008 @ 9:47 am |

moontrader ……….is there a possibility that on 25th of November we have a top instead of a bottom ? In other words while I think the date is good for a reversal I’m not so sure what part the reversal is directed to. If we begin going up tomorrow I think it could be a top. Any chance for that ?

(Tra parentesi o BTW che dir si voglia,…. sono di Verona, in Veneto, circa 80 km a sud di Trento………..In Veneto c’e’ questo detto : Veneziani …gran signori, Padovani …gran dottori, Vicentini …..mangia gatti

, Veronesi ………tutti matti. Percio’ forse i Trentini sono matti perche’ risentono della nostra vicinanza dato anche che parlano esattamente come noi…….salvo due o tre parole differenti. Faccio i miei migliori auguri a te ed alla tua futura moglie di nuovo, questa volta in italiano che mi sembra tu capisca e parli perfettamente. Ciao e tutto il meglio a te e tua moglie.)

Comment by giorgio — November 17, 2008 @ 11:13 am |

Hey Giorgio, of course it’s possible to be a top. Anything can happen, this is the first and most important principle of the market. However, according to my analysis, the probability of a significant bottom is higher than a top. Also, remember than we had an important bottom last week on the 13th, so when you say “if we begin going up tomorrow” I’m not sure what bottom you’re referring to.

Comment by moontrader — November 17, 2008 @ 11:34 am |

Giorgio, grazie per gli auguri. Divertente la definizione dei cittadini. :)

Comment by moontrader — November 17, 2008 @ 11:39 am |

>25th of November we have a top instead of a bottom

No it can’t! It’s a Turkey day early bird special!

Have u listen to Larry Pesavento? he said 28th is an UP day 95% of the time

Comment by Forkoholic Serge — November 17, 2008 @ 1:25 pm |

the question was due to the fact that the analysis of cycles often is unable to establish if what you are going to have is a bottom or a top, and a pattern I’ m strictly following leaves the door open to this kind of doubt. But to tell the truth the analysis of Moontrader seems to link together tops with tops and bottoms with bottoms, so his 24th-26th time window should coincide with a low which could be an important bottom. If I have not taken ”luccioe per lanterne”. Moontrader …you know what the saying means. Best luck to everyone in this blog.

Comment by giorgio — November 17, 2008 @ 1:56 pm |

Giorgio, you are right, it’s always good to have the door open and trade according to the edge you create or recognize. In past posts I showed tops that turned out into bottoms and vice-versa. This is always tricky – this market is absolutely crazy – and we have to always keep our mind open. That’s why I try to combine these projections with other indicators, to have a better edge to trade. One last advice: if you see something here that goes against your edge or forecast, then you should give priority to your own stuff. Simply because you know where your stuff comes from and you should trade according to your own criteria.

Comment by moontrader — November 17, 2008 @ 2:16 pm |

I have created a chart with the spiral calendar dates counting backwards from 11/25/2008 at:

Most (although not all) of these dates coincide to the day with significant highs or lows since the all time top. This is kind a of a corollary chart to the one posted above.

So more evidence of something significant around 11/25/08.

Comment by Dave — November 22, 2008 @ 4:28 pm |

[…] Comment by Dave — November 22, 2008 @ 4:28 pm […]

Pingback by S P I R A L &nb — December 8, 2008 @ 12:37 am |